How To Value A Business

How much would you pay for $1?

Over the weekend a friend told me he wanted to invest in Nvidia. My first thought was do you really want to pay $80 for $1 of free cash flow.*

*(Nvidia currently trades with a market cap. of $2.2tn, we subtract the ~$26bn cash/short term investments on the balance sheet and divide by ~$27bn in free cash flow in 2023 to get $80 figure).The question got me thinking, how much should we be willing to spend for $1 of annual free cash flow? After all the entire goal of value investing is to spend money now to buy a business that will continue to deliver cash in the future, with the aim that the cash returned will reward the investor with a healthy return.

Buying a $1 business

If we take a basic example, how much should we pay for a business that generates $1 in annual free cash flow. The common back-of-the-envelope method is to apply a multiple of say 10x or 20x, depending on how other comparable businesses are valued. Paying $10-20 for our $1 business, we would get our money back in a 10-20 year period.

But spending $20 so you can get the same back in 20 years isn’t a great investment; $20 is worth around $11 after 20 years with a modest 3% inflation rate. What makes businesses so attractive as investments is that they not only generate cash, but a good business will grow its revenue and will re-invest the cash back into the business to deliver future earnings growth. So in our imaginary $1 business, how do growth projections change the picture? If the business were to increase its free cash flows by 15% every year we recover our investment after 7 years if we paid $10, and after 10 years if we paid $20. By the end of 10 years we receive $3.52 in free cash flow per year and the business is now valued at $35-70 (depending on our multiple).

Instead of asking "how much should I pay for a business" we can flip the question around and ask "by how much does the company need to grow to justify the current market price?"

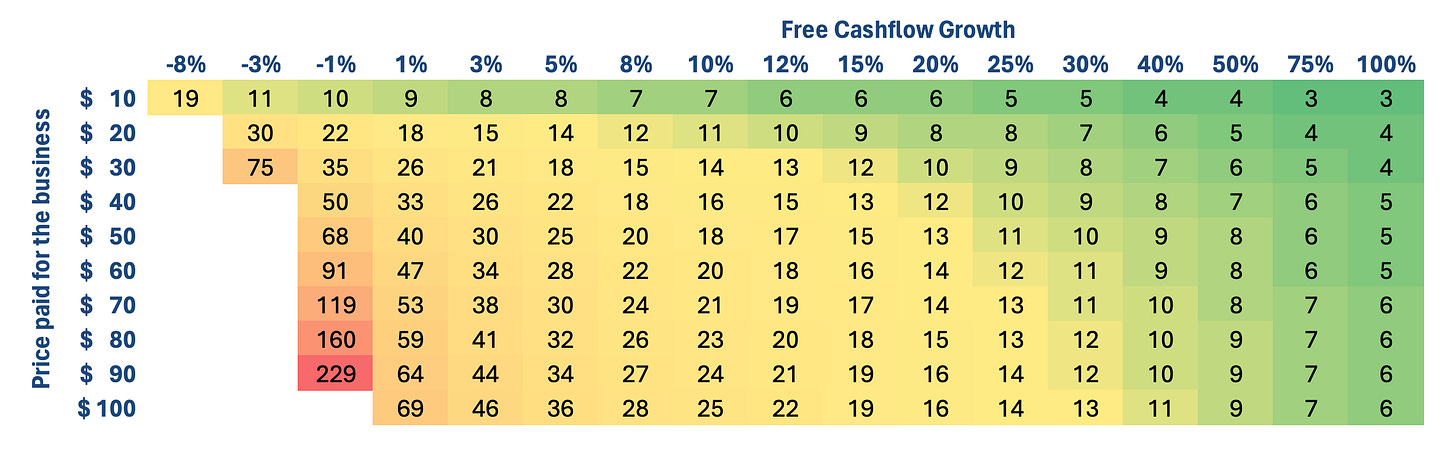

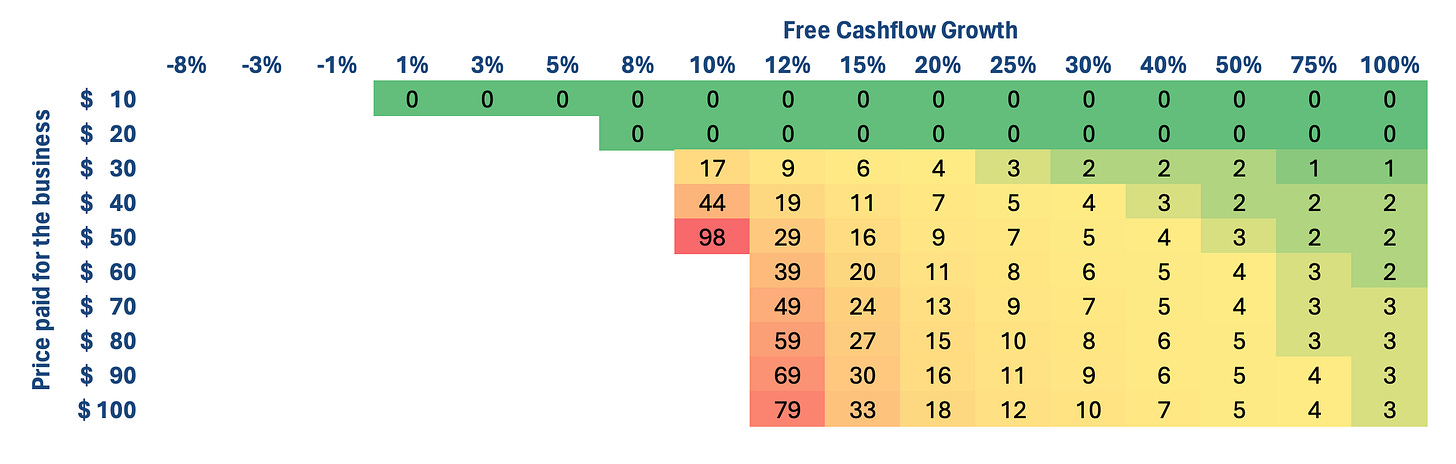

We can see that the price we pay for a business has a built in growth requirement if we expect to get our money back in a reasonable time period. We can ask the question “What growth rates are necessary just to recover my investment”. Here we have calculated the number of years required to recover the price paid for the business for different valuations ($10 = 10x free cash flow, $80 = 80x free cash flow etc.). Then along the top we track the free cash flow growth rate and the table provides the number of years we need to wait to get our money back.

Price is everything when buying a business. When paying $10 for our $1 business, we can still get our initial investment back in 10 years even if free cash flow declines by -1% per year. $20 requires a slightly steeper 12% growth, and paying $80 (looking at you Nvidia) requires a sustained 40% free cash flow growth every year for 10 years just to get our money back.

Achieving Investment Returns

So far this is just to recover the initial investment we made in the company but as investors we’d like to make a healthy return on our money. We can also assume that at the end of the period we can re-sell the business, so the value is not just the cash we receive but also the resale value at the end.

To account for inflation and our desired investment return we update our model to apply a discount rate of 12% so that cash is devalued by 12% every year into the future. At the end of the 10 year period we calculate the terminal value as the discounted cash flow at year 10, times by 20x multiple.

Now the picture changes, buying the business for 10-20x free cash flow, we can always get our desired return from the cash flow and by simply re-selling the business. Paying 30-50x requires a sustained growth rate of 12-20%, and paying 80x requires 25%+ growth to hit our return goals.

So if you are buying Nvidia today, you are implicitly signing up to the expectation that it will grow its free cash flow by 20-25% per year every year for 10-15 years. Is this a fair assumption? Our model assumes that 20x is a fair multiple and if you pay more for the business it will revert to this fair multiple in the due course of time. Many Nvidia investors may assume the high multiple will continue for years to come, but the market is under no obligation to do so.

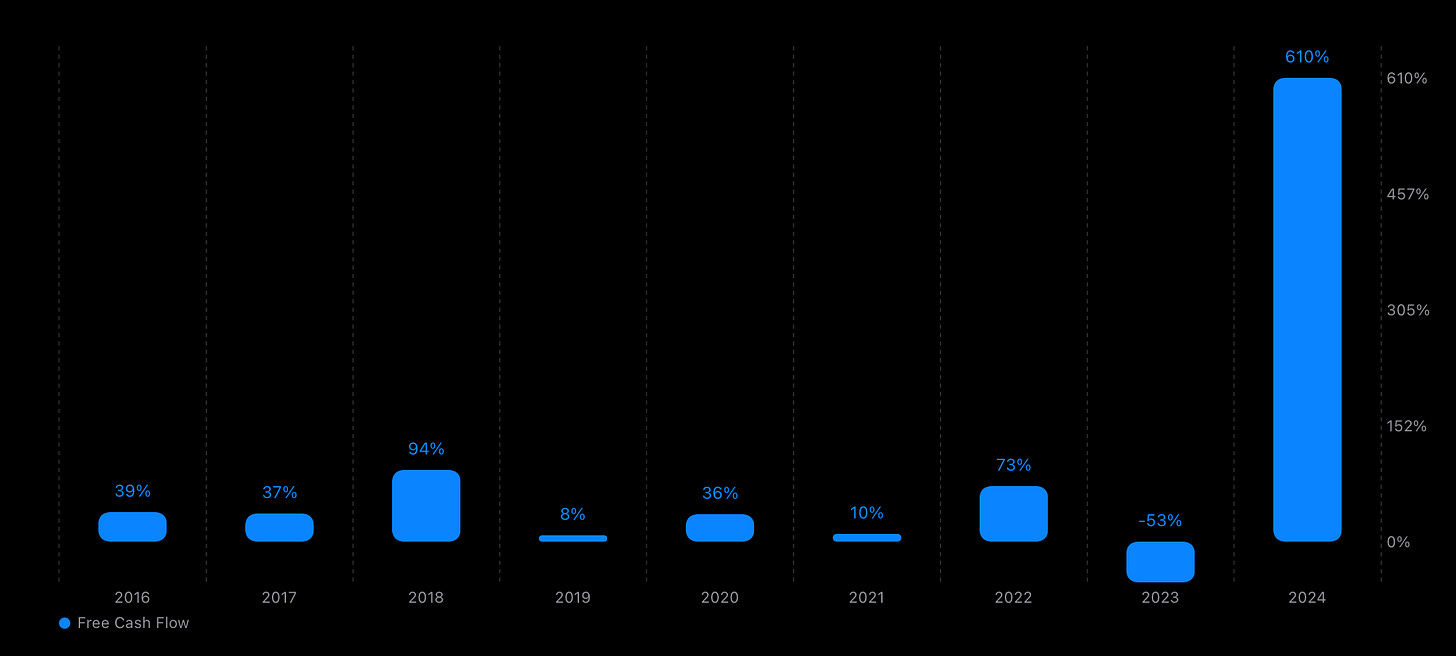

Looking at the past 10 years, Nvidia has had an impressive track record, growing at a 55.6% CAGR since 2015, and an average of 30% (25% CAGR) between 2015-2022 if we exclude the 2023 bumper year.

Can the growth be sustained? The market clearly thinks so. Nvidia has certainly ridden the recent waves of Crypto and AI to stellar success. Whether these trends will continue to power 25% growth remains to be seen, we don’t think competitors like Intel or AMD are going to stand by and let Nvidia take all the action. Apple has also entered the game with their combined CPU/GPU M* series chips, which may not match Nvidia in performance but do exceed in terms of efficiency and power use; ideally suited to their mobile and personal devices.

Discounted Cash Flow Modelling

Putting Nvidia aside, the process we went through goes to the core of Discounted Cash Flow Modelling, an essential tool for investors to assess the value of a business:

Predict the future cashflows for the business from now to n years into the future.

Discount the future cashflows at an appropriate rate - as cash now is more valuable than cash in the future.

Sum the future discounted cashflows to give the total cash the investor will get from the business over a period of n years.

Finally, if the investor wishes to eventually sell the business, calculate the terminal value of the business n years in the future at which point the investor will see the business - usually by valuing the business as an appropriate multiple of the free cashflow in that year.

The present value of the business can then be calculated as: the sum of the discounted cash flows + the terminal value of the business + any cash or short term investments currently held by the business.

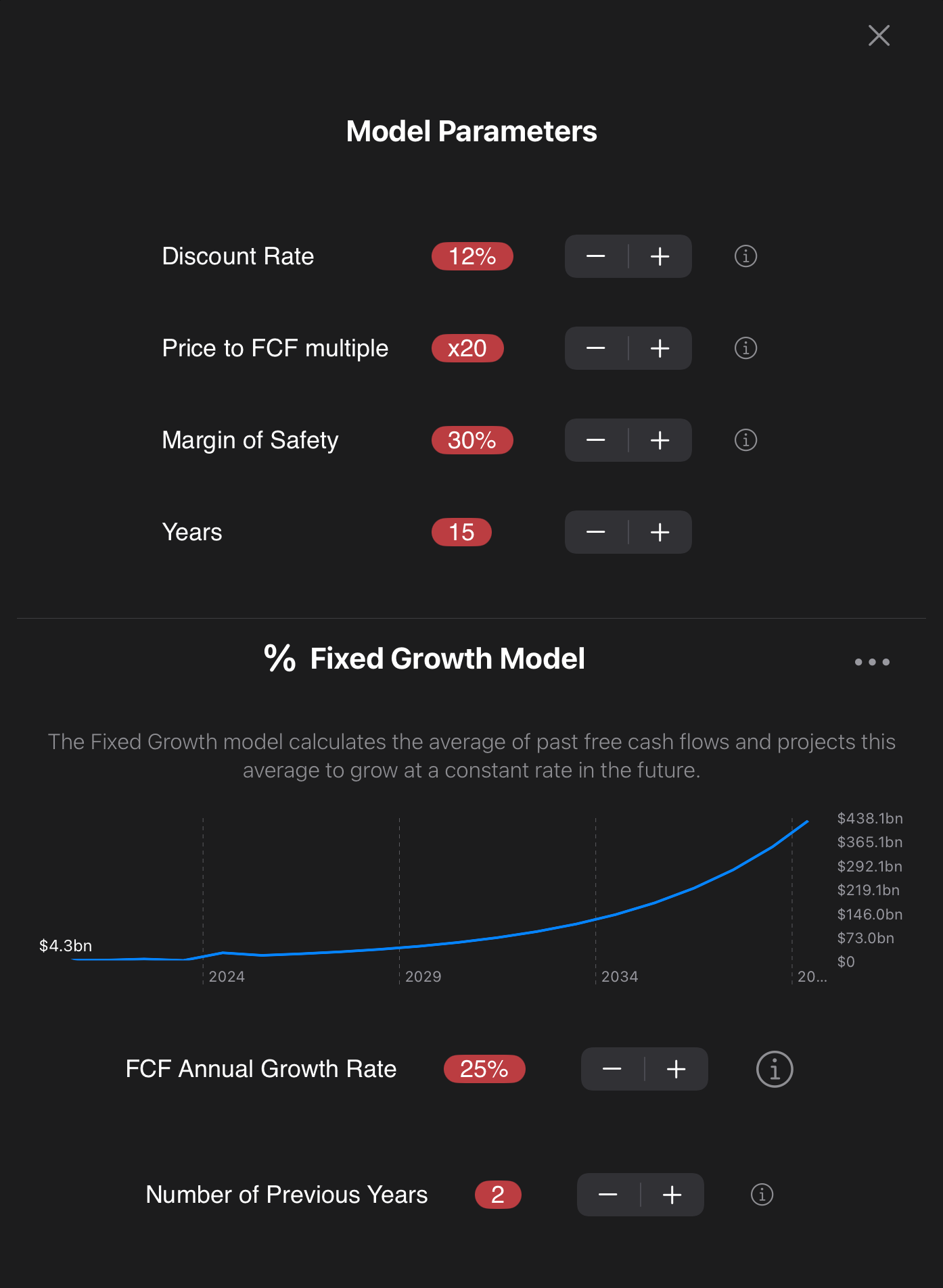

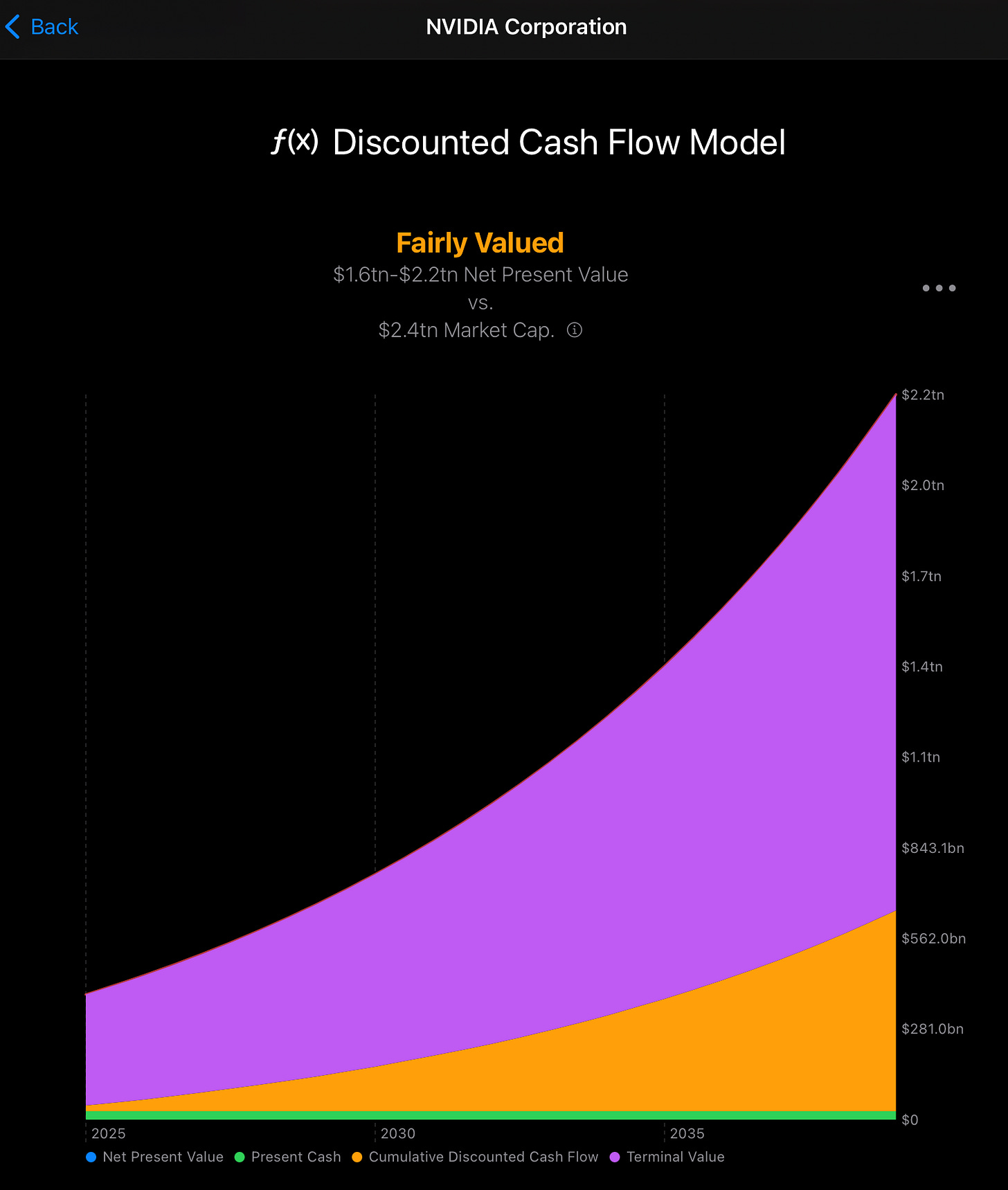

At phron.io we simplify this process by adding a Discounted Cash Flow model that automatically projects cash flows into the future and determine if the business is overvalued or undervalued based on the projections.

By tweaking the model parameters we can determine what is the implicit growth required to justify the fair valuation of the current market capitalization of the business.

There are multiple ways to forecast future cash flow, here we just assume a fixed growth rate going forward. You can also use a linear regression model to project cash flows into the future based on the past trend, or even manually enter if you want plot the future cash flows yourself.

Thanks for reading! Don’t forget to subscribe and leave a comment!