UFPI: Wood you take a look at this one!

A stable and diversified acquirer that should not be underestimated.

UFP Industries Inc.

Firstly, welcome to our Substack and our first post! Our goal is to provide detailed analysis of hidden gems in the small to mid-cap range. In our first post we analyse UFPI: Universal Forest Products Industries. We first invested in this diversified company in the lows of 2023 - when the market cap hovered around $4.7bn-$4.9bn. At the time we considered it undervalued to intrinsic value and since the market has reevaluated its valuation upward by about 48%. At the time of writing the market cap is touching $7bn.

The Summary:

A diversified business with multiple business segments and geographies.

Quality, experienced management focused on balanced capital allocation and acquisitions to power growth.

Healthy and growing cash flows, balanced Capital Allocation program to fuel future growth and return value to shareholders.

Seasoned management is committed to moving up the value chain in all segments.

Let’s dive in.

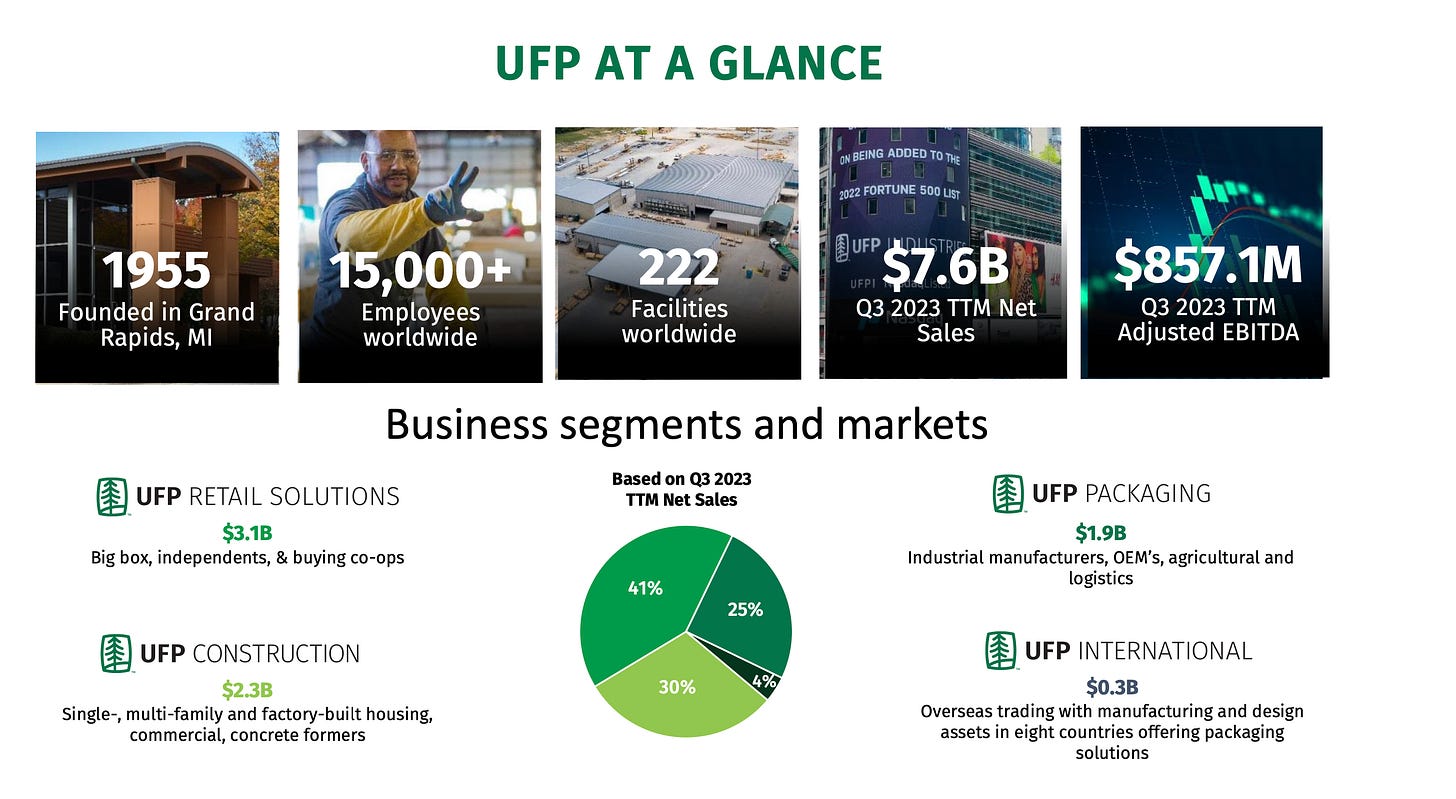

1. The Business

UFPI is a holding company based out of Grand Rapids, MI founded in 1955 as a lumber supplier to the manufactured housing industry. The company boasts it has been profitable every year since inception in 1955; going public in 1993. It has 3 main business segments, Retail, Packaging and Construction and a smaller International segment. It is geographically diverse, with 221 facilities worldwide spread across US (197), India (9), Australia (5), Mexico (4), Canada (2), the UAE (2), the UK (1), Spain (1), and China (1).

Retail Solutions

Retail is the largest segment (~41%) providing products like decking and railings through the business units: ProWood and Sunbelt, Deckorators and UFP-Edge.

ProWood and Sunbelt sell pressured-treated, fire retardant lumber products such as fencing, lattice and decking for outdoor environments. Deckorators supplies composite decking and decking accessories based on its patented mineral based composite decking and wood plastic composite. UFP-Edge manufactures and sells exterior sliding, pattern and facia products using traditional, engineered and modified wood.

The retail segment faces competition from mostly regional players on an individual product basis, but there are no known competitor that currently manufacture, treat and distribute the range of products on a national basis in the same way as UFPI.

As the two largest customers, Home Depot and Lowes, account for 15% and 11% respectively of sales in this segment in 2022, changed from 16% and 10% in 2021, and 24% and 4% in 2020 suggesting that it has diversified away from Home Depot in recent years towards Lowes and other customers.

The company occupies a sizable market share, estimating that they produce approximately 28% of all residential treated wood in the USA, 5-6% of all composite decking and accessories, and 9% of all wood and vinyl fencing.

A key differentiator in this segment is the rapid turnaround it can achieve delivering mixed truckloads of products delivered from regional facilities in short time from receipt of an order. The “low maintenance” decking is considered to be a favorite choice amongst contractors.

Construction

The construction is the next largest segment (~30%) features the business units: Factory-Built Housing, Site-Built Construction, Commercial Construction, and Concrete Forming.

Factory-Built Housing designs and manufactures custom roof trusses for manufactured housing. The company estimates it produces 45% of all roof trusses for factory-built housing in the USA. Again it’s differentiator in this field is the regional facilities, but increasingly it also provides design and engineering support services.

Site-Built Construction designs and manufactures roof and floor trusses and other lumber packages to frame residential and light commercial projects. They estimate they provide approximately 6% of all engineered wood components used in housing in the USA.

Commercial Construction designs, manufactures and installs highly customized interior fixtures and casework primarily through the operations of idX Holdings.

Concrete Forming unit designs and manufactures wood forms used to form concrete for structures such as large parking garages, stadiums, bridges and other infrastructure projects.

Packaging

Packaging accounts for about 25% of the business and delivers various packaging solutions through the units: Structural Packaging, PalletOne and Protective Packaging Solutions.

Structural Packaging designs, engineers and manufactures custom packaging products made of wood. The products are custom and designed according to customer specifications and serves a variety of regional, national and global customers.

PalletOne designs and manufactures wood and heat-treated wood pallets in variety of sizes and compositions used by customers for shipping a wide assortment of consumer and industrial products.

Protective Packaging Solutions features a wide variety of products and solutions and are sold primarily as additional offerings to structural and pallet packing products to provide a more complete solution for customers.

As with retail, competition in packaging is fragmented. They currently believe they provide 15% of all US domestic customized structural packaging with a 10% market share of wood pallets.

Purchasing & Suppliers

Given the size and scale of the business it is one of the largest domestic buyers of softwood lumber from lumber mills in the USA, purchasing approximately 7% of softwood production in North America. This has allowed it to maintain long-term relationships with many suppliers leading to better management of raw material inventory, lowering costs and mitigating the volatility of lumber prices.

2. The Management

Reading through the annual report and quarterly earning transcripts the management come across as experienced (many with long tenure at the company - averaging 23 years at the company), sensible and optimistic about their company. The company struggled during the downturn after the financial crisis of 2008 but the subsequent restructuring during this time paved the way for future growth.

“Today we are a more efficient organization than we were three years ago. And then to be honest with you we are a more efficient organization today than we were last week” - UFPI Q4/2009 Earnings Call Transcript

All plants are profit centres and bonuses are calculated based on return on investment. The firm fosters an operator mentality in management requiring managers to own stock in the company. We like the level of insider ownership and levels of tenure amount senior leaders and managers.

The company has a dedicated sales team and management have set targets regarding gross margins to achieve. If deals don’t meet the gross margins hurdles they are comfortable walking away instead chasing down every deal.

3. Financials

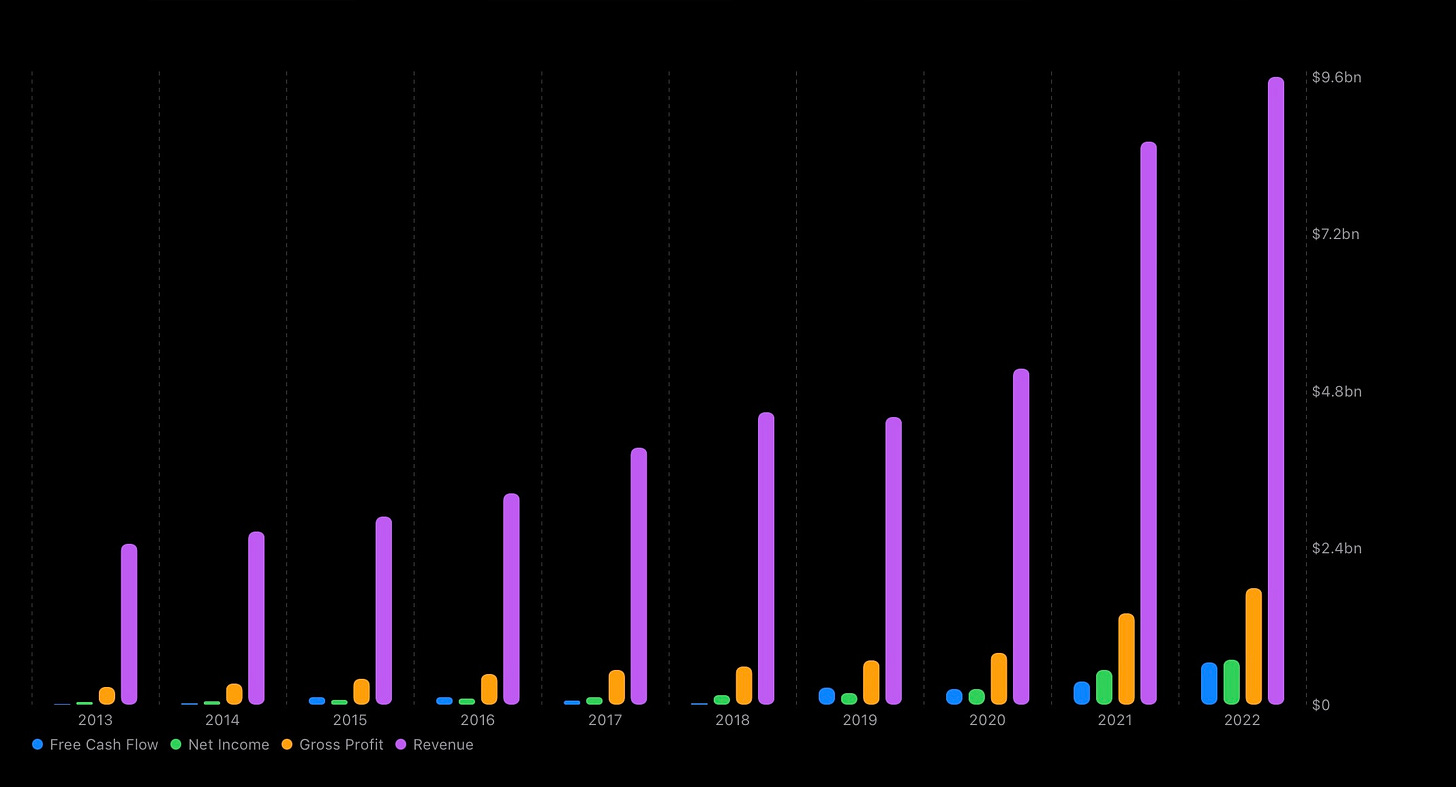

Looking at the financials, revenue grew a 16% CAGR from $2.5bn in 2013 to $9.6bn in 2022. During the same time period Gross Profit grew at ~23% CAGR from $280.6m to $1.8bn, Net Income at ~36% CAGR from $43.1m to $692.7m, and Free Cash Flow at a stunning 54% CAGR from $13.2m to $657.4m. The number speak for themselves, but the operational improvements have driven improved profit and free cash margins over this time on top of the revenue growth.

Q4/2023 numbers have yet to be announced, but it looks like revenue will decline overall in 2023 compared to 2022. Q3/2023 net sales were down -16% compared to 2022 driven by reduced lumber prices and reduced volume due to a decline in housing starts.

Despite a depressed year in 2023, we still expect UFPI to generate healthy cash flows, to continue its Capital Allocation program. It ends 2023 with ~$957m in cash or cash equivalents on the balance sheet, $2.5bn in Current Assets vs. $604m in Current Liabilities and low long term debt levels of ~$273.m demonstrating a very health balance sheet.

4. Capital Allocation

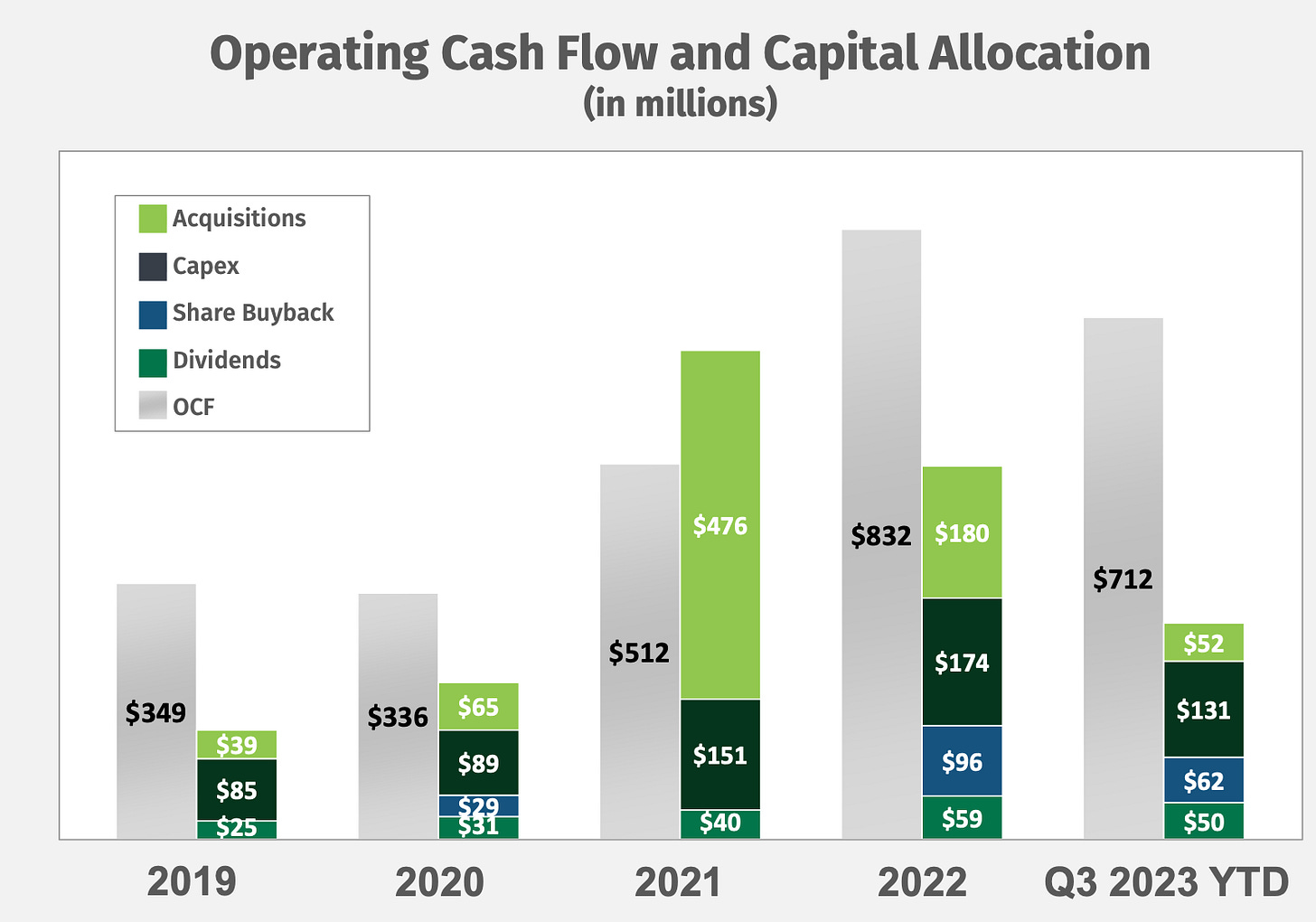

Management has set a balanced model for capital allocation of cash flow, spreading across acquisitions, Capex, “opportunistic” share buybacks and dividends. We believe the share buybacks program at current low price levels will reward shareholders in the long run.

A key aspect of its growth strategy is through acquisitions with a team dedicated to identifying acquisition targets. In a fractured and regional field, we believe UFPI stands as a unique national and international player with potential to establish dominance through targeted acquisitions.

Management has stated their goal to move up the value chain by providing higher value services in design, engineering and support; we believe their acquisition pipeline will help support this goal and move the company beyond raw manufacteuring.

The low levels of Capex required to fund growth is a feature we look for in all investment opportunities and UFPI has a solid record, in recent years dedicating 20-30% of Net Income for Capital Expenditure.

5. Valuation

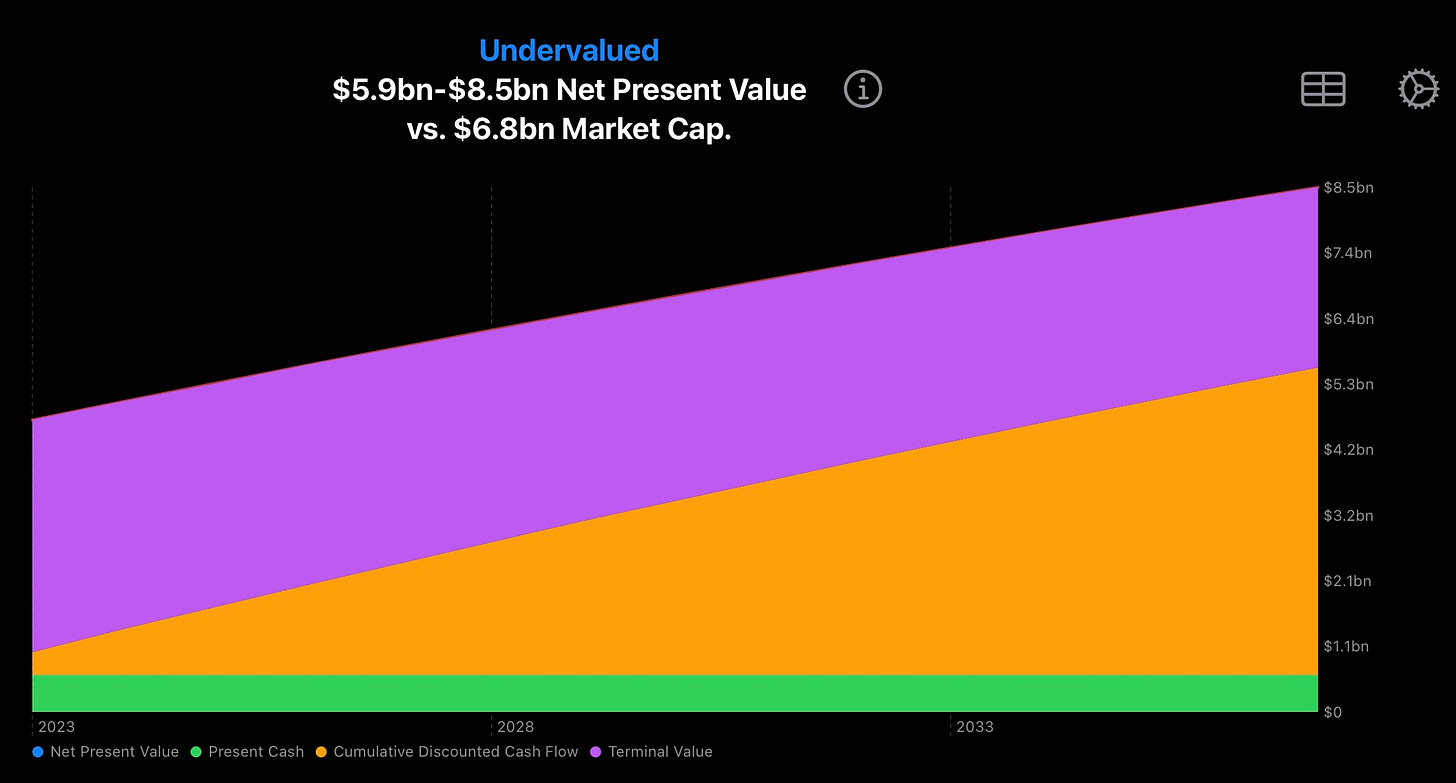

Performing a quick Discounted Cash Flow Model on UFPI, it’s hard to conclude it is anything other than undervalued:

In this model we assume a 10% Free Cash Flow growth going forward - using the average of the last 4 years of FCF to smooth out the bumper years in 2021 and 2022. A 12% discount rate, 30% margin of safety and a terminal market price of around 10x Free Cash Flow. Even with such conservative assumptions the Net Present Value comes somewhere between $5.9bn-$8.5bn vs. the ~$7bn current Market Capitalization.

6. Risks

UFPI isn’t without risks. Despite being well diversified and robust, it is still heavily subject to price fluctuations in lumber prices. It is heavily impacted by crashes in housing starts and homebuilding which has clearly impacted sales in 2023.

It should also be noted that 2021 and 2022 were particularly stellar years for the company as high lumber prices fueled record profits. The high interest environment will certainly reign in profits.

Another aspect often mentioned during the quarterly earning calls is the challenge they face hiring quality employees and training the next generation of managers and leaders within the company. The current management is seasoned and stable, but they will not be around forever. Fortunately they are aware of these challenges and regularly enhance their internal training programs to foster talent and grow the next generation.

7. Summary

“The best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return.” - Warren Buffett, Berkshire Hathaway (Source: 1992 Shareholder Letter)The gold standard of value investing are quality businesses that generate healthy free cash flow and sensibly allocate that cash at high rates of return for future growth.

In an era when investors look for quick returns in the next Nvidia, sometimes the unsexy quality businesses can be overlooked and we believe this has been the case for UFPI. While the market currently prices UFPI as a raw materials manufacturer we believe there is scope and potential for the company to move up the value chain through acquisitions and investment.

UFPI passes our criteria for a high quality business in many regards: seasoned management, diversified business segments, healthy and growing free cash flows, robust balance sheet and financial statements, reinvesting for future growth and expansion while also rewarding shareholders through dividends and buy backs.

Thanks for following our first post, leave a comment with your thoughts and consider subscribing for more posts like this.