Fever-Tree Drinks: going flat or plenty of fizz?

Is the beleaguered drinks company in a temporary lull or building for the future?

History

Fever-Tree Drinks was founded in 2004 by Charles Rolls and Tim Warrillow on the simple principle that if you are going to treat yourself to alcoholic drink, with some expensive top-shelf liquor, it matters what you are going to mix the other three-quarters of the drink with. While the liquor side of the drinks market had been exploding with a new range of artisan gins, tequilas and whiskeys, established players in the mixer market (like Schweppes) had left the goal open for disruption.

Fever-Tree’s first product was launched in 2005. The premium Indian Tonic Water quickly became the market leader in the United Kingdom and remains the dominant brand today in its home market. An initial investment after the IPO in November 2014 would have rewarded the investor with a 2200% return at the peak in 2018. Revenues have grown at 27% CAGR since 2013.

Part of the success in the UK was the on-premise exposure. Every drink served with the accompanying Fever-Tree bottle was a free marketing opportunity that helped cement the brand and drive off-trade (supermarket, store) sales. Such a go-to-market strategy was key to early the success, but observers were skeptical the same mechanism could be applied to larger markets like the US where soda streams are more established in bars and restaurants.

The company was hit by multiple headwinds, the COVID pandemic and the lockdowns naturally hit On-Trade sales (bars, restaurants, venues etc.) but Off-Trade (supermarket, stores etc.) held strong. The consequent inflationary energy crisis in Europe in 2021-22 significantly impacted the glass bottling costs with Operating Expenses substantially eating into Net Income.

Since the peak in 2018, the market euphoria has abated and the shares have declined some 73% from the all time high. Long-term shareholders are naturally disappointed that the company has failed to maintain momentum. Famed UK investor Nick Train described Fever-Tree as his “biggest embarrassment” in 2023.

Margin Squeeze

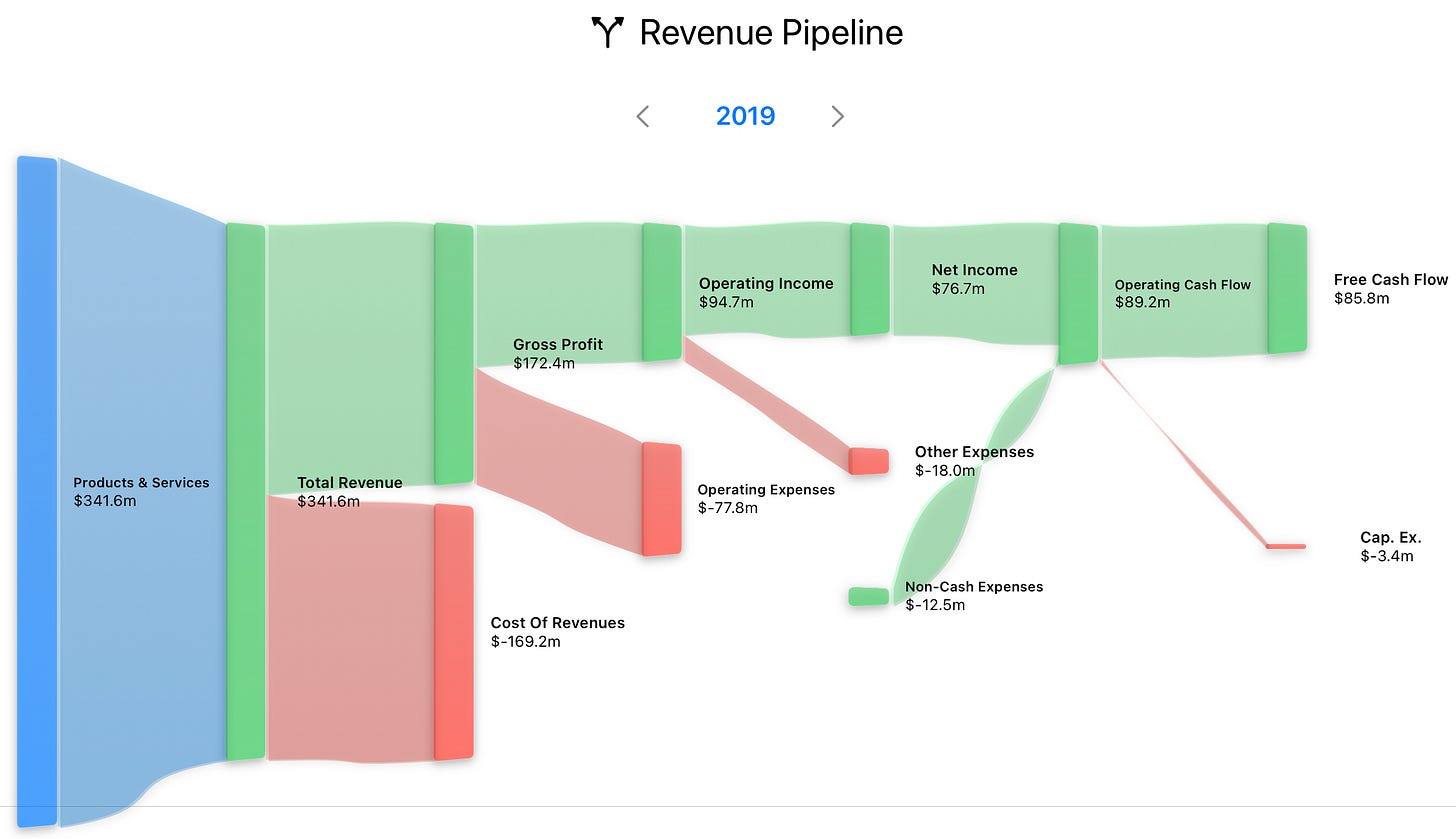

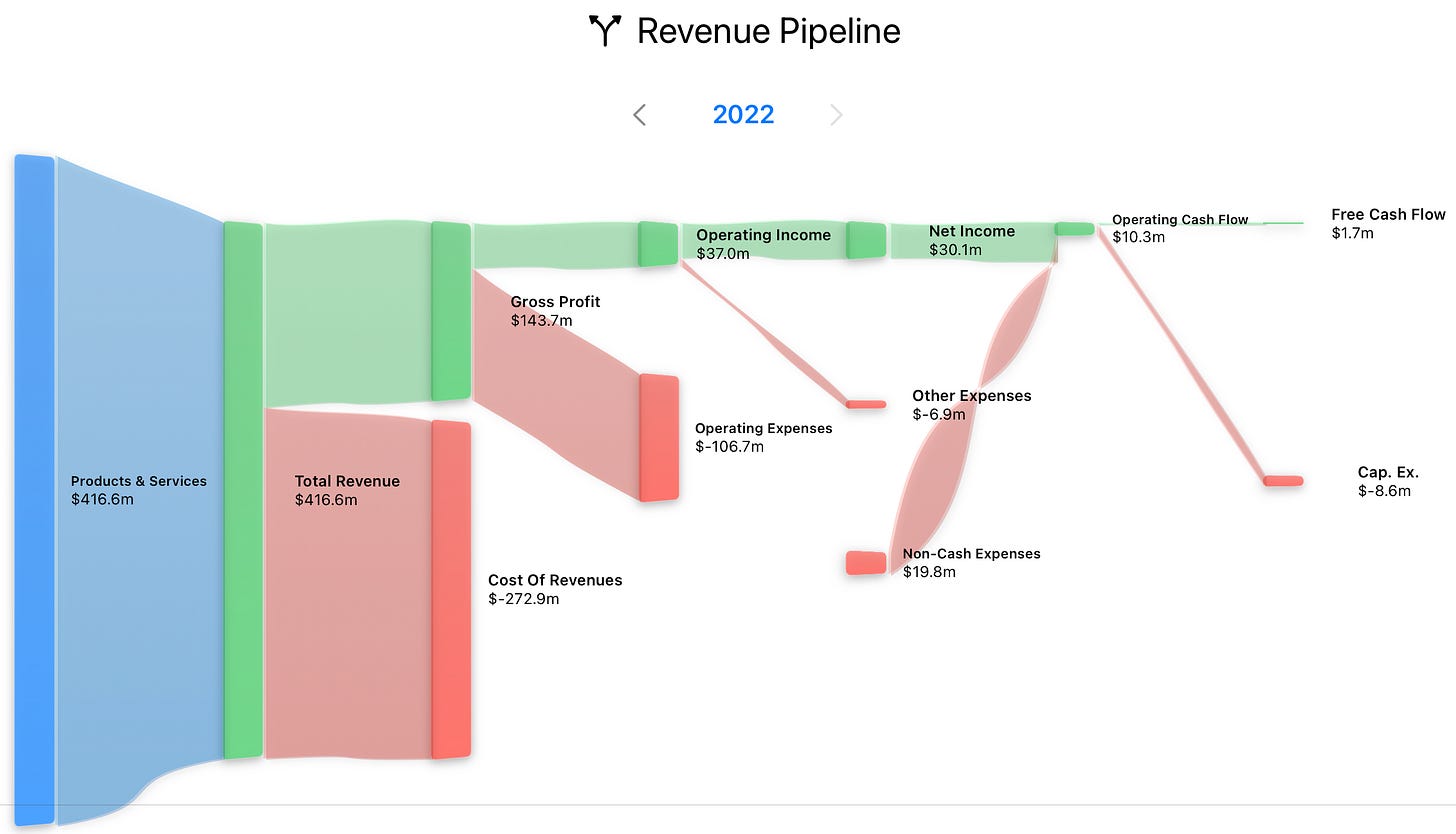

Looking at margins, we only need to compare 2019 and 2022. Fever-Tree went from generating $85m on $341.6m in revenue (a 25% free cash flow/revenue), to less than $1.7m in 2022 despite growing revenue to $416m (0.4% fcf/revenue!) in 2022.

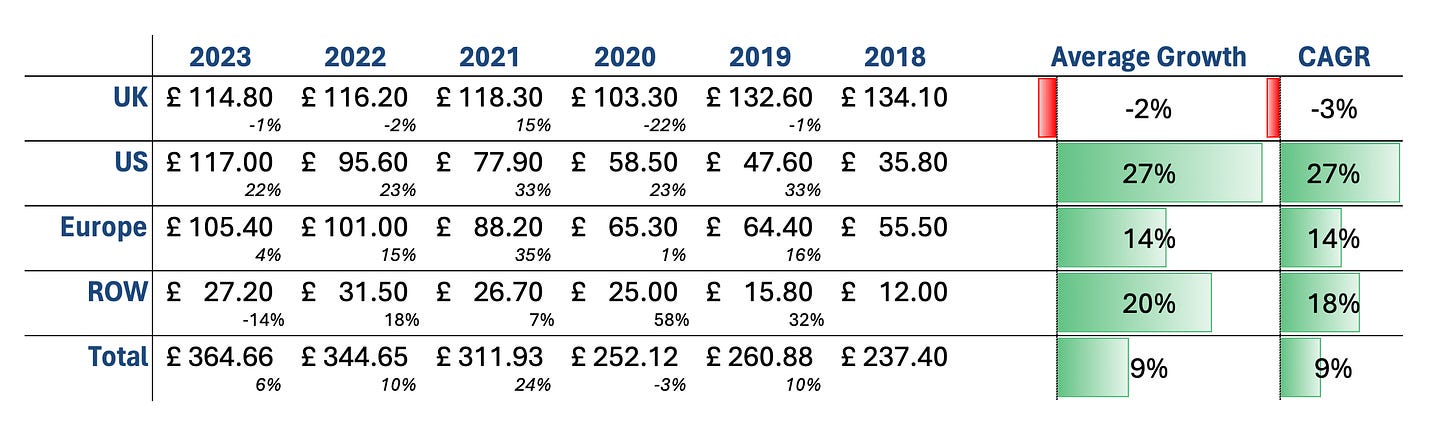

Before the pandemic all eyes were on cracking the US market to power growth and dethrone the soda stream. On this score the business appears to have succeeded with the United States overtaking the UK to be the largest market in 2023 with an average annual growth rate of ~27% since 2018. But margin challenges have long since eclipsed US growth as the primary goal for the company, and revenue growth alone will no longer save the company.

Looking at revenue growth since 2018, the most mature market of the UK has languished but the remaining markets of the US, Europe and Rest of the World have held strong resulting in a respectable 9% overall annual growth rate since 2018:

Despite impressive growth numbers outside the UK, the growth decline in the UK raises concerns about the total addressable market for its products and the impact of competitors. If it can’t achieve steady growth in its most mature market, coming out of a pandemic, then we should be concerned about a ceiling for revenue in other markets too.

Management emphasize margin improvements will be driven by new glass contracts with fully hedged energy pricing, lower Trans-Atlantic freight rates, supply chain optimisations and cost savings. While all this will help, a company of its scale and reach should not be so dependent on the fluctuations of bottling and transit costs. Rumour swirl about problems bringing online their US bottling plants; on-shoring production clearly has not provided the boost needed to transition away from sea shipments.

Outlook

Did Fever-Tree just enjoy first mover advantage coupled with the tailwind trend of premium spirits gaining market share over wine and beer, or is there some lasting value here? Despite the recent doom and gloom, there are still reasons to be optimistic about Fever-Tree.

Firstly, the management is sensible and seasoned, with many directors hired with long term experience in the soft drinks industry (the US CEO is the former President and CEO of Belvedere Vodka; a number of directors with substantial experience, soft drinks and supply chains for the likes of PepsiCo). Management still has a good level of insider ownership, estimated to be around 10% of outstanding shares. The company model is asset-light and outsourced. With only 300 employees Fever-Tree has launched into a global brand with a range of popular products.

Competition is hotting up in the mixer market with new entrants like Q-Mixers and established players like Schweppes developing their own premium brands. A host of regional and national mixers such as Fentimans and Mil 976 will eat into market share. It is curious that these companies have produced an almost identical product line-up and strategy, a testament to what Warren Buffett describes as an iron law of Capitalism: unless you have a wide moat others are going to do their level best to storm your castle and seize the prize.

Despite this, it’s hard to see how these products can catch-up to the premium brand, scale and distribution model of Fever-Tree. Once customers find a mixer they like there will be little incentive to risk disappointment by switching and smaller players will struggle to win major contracts with large scale distributors, airlines, hotels and other venues.

Q-Mixers is a substantially smaller privately owned company still in growth mode, clearly lacking the same scale and brand quality or awareness as Fever-Tree. Schweppes is a brand that is licensed by 5 different companies across different regions and suffers from a lower quality perception with customers. This fragmentation made it harder for Schweppes to respond with a counter-attack worldwide, but not impossible. In Spain, where gin and tonic is huge, Fever-Tree struggled to gain market share because Schweppes had so much to lose. They responded fast with a premium tonic and held onto their market position.

Fever-Tree is replicating its go-to-market strategy in the US by deepening relationships with Walmart, Wholefoods, Target, Marriott, Four Seasons and Hyatt. It also partners with national distributors like Southern Glazer’s in the United States (with a 35% market share in wine and spirits distribution) and Asahi in Japan for improved go-to market; whereas competitors rely more on direct sales teams for distribution. Of all the mixer companies Fever-Tree also has the longest and deepest partnerships with alcohol companies like Diageo, Pernod Ricard and Beam Suntory that helps it both develop new products and pair with liquors at both on and off-trade points of sale.

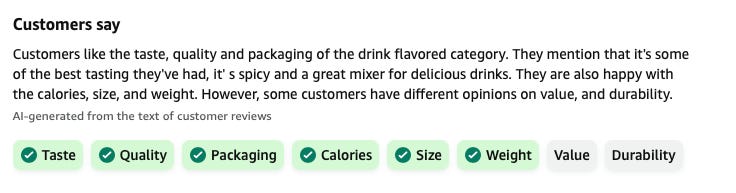

The company has a number of wonderful products well loved by customers. They have a track record of quality drinks and innovative products that fill a gap in the market where fewer others operate. They clearly take pride in the ingredients and sources for their drinks, boasting 3 different types of ginger for their ginger beer and ingredients sourced from all over the world. The brand is established and increasingly well known worldwide for quality and customers trust. If you are going to treat yourself to a drink why would you ruin it with a substandard mixer, or risk disappointment by saving a few dollars.

More than anything we are optimistic about the return of On-Trade sales. Fever-Tree is already a favourite among bartenders and the increasing penetration into hotels and bars serve as another avenue of marketing and brand awareness. Each drink served in a bar or restaurant, with the accompanying Fever-Tree bottle is an opportunity for free marketing and organically growing off-trade sales.

Product Line up

Leadership within the company emphasize innovation as the path of forward, and on this front they have demonstrated that they can expand beyond just tonics into markets like the US where G&T is not as popular. The Ginger Beer range and Sparkling Pink Grapefruit have been instrumental in driving in growth in the US and other markets where whiskey, tequila and other liquors are more popular than gin. The expectation in the alcohol industry is that spirits will continue to gain market share over wine and beer, and so expand the market for mixers and long drinks.

Coming to market soon are ready made cocktail mixers such as Fever-Tree Margherita, Mojito, Espresso Martini and Bloody Mary Mixer. Going on sale now in the UK are adult soft drinks, partly a tacit acceptance that their drinks are enjoyed both as a mixer and also standalone. We think Fever-Tree has both the brand and reach to make a success of each of these new product lines.

What will make Fever-Tree successful is its brand, dependability, customer loyalty and ability to command a premium price above competition. After all, go to Safeway of Wholefoods and you will see a range of existing mixers, cocktail mixers and adult soft drinks; there is no shortage of competition so the differentiator will be it’s brand and go-to-market strategy and most importantly a sustainable strategy to control its bottom line compared smaller competitors.

Conclusion

We trimmed our holdings of Fever-Tree in 2023 as part of an end of year tax harvesting strategy. Despite optimism, we think Fever-Tree is still on the “too hard” pile for now as revenue growth has slowed to 6% in 2023 and margins are still recovering. We give Fever-Tree a HOLD status and await margin improvements before re-evaluating. A wonderful brand is not enough if a business can’t control its margins and profits can be buffeted so substantially by external forces.

Management has reiterated their guidance of 10% revenue growth and 15% EBITDA margin for 2024, but really for a premium drinks company with a great brand and customer loyalty we should be seeing EBITDA and Net Income Margins at historical levels of up to 30% or more. At such margins the current market capitalisation of $1.2bn will look substantially cheap at only around 10 times free cash flow, but for now we believe it is fairly priced.

A great business going through a difficult - if transitory - times should pique the interest of any value investor, so will continue to monitor Fever-Tree and eagerly await substantial improvements in the business’s bottom-line.